7.28.21

By Jennifer Jacobus, PHRca, SDEA Director of HR Services.

SDEA has been receiving an increase in member phone calls regarding employees working remotely in other states. With remote work here to stay for most of us, the option to live and work somewhere else, even another state, and still perform the job functions is appealing to many workers.

Working remotely from a state that is different to the state in which the company operates in, opens a new set of compliance related issues for the employer. Employers need to comply with the employment laws that are associated with the state in which the employee works and lives. This may be a sigh of relief for many, since California employment laws, in comparison to other states, have a tendency to greatly favor the employee. However, there may be nuances in the state that your employee is working in that you are not aware of. California employers may consider the option of applying California law for all employees, even those working in other states, which typically provides a greater benefit for the out-of-state workers. As an example, California requires the payment of daily overtime. Most states comply with federal law only and do not have state laws requiring anything other than the payment of weekly overtime; but employers are encouraged to do their homework. Employers must do their research and see where the state laws differ and how this might affect their policies, procedures and payroll.

The other nuance employers face is related to payroll taxes. Employers with employees working in other states should apply for a license to operate in that state and pay appropriate state taxes. There may be ways around this when an employee files their personal taxes. Both the employer and the employee are strongly encouraged to talk to their CPA or someone that can help with state payroll and business taxes.

Remember that if an employee is moving to a state in a different time zone, to communicate working hours and expectations. Also, employees who are working from home or another location, whether in the same state that the business operates in or not, must be compensated for travel time and potentially mileage reimbursement if they are required to come to the “office” for a meeting, training or other business-related reason.

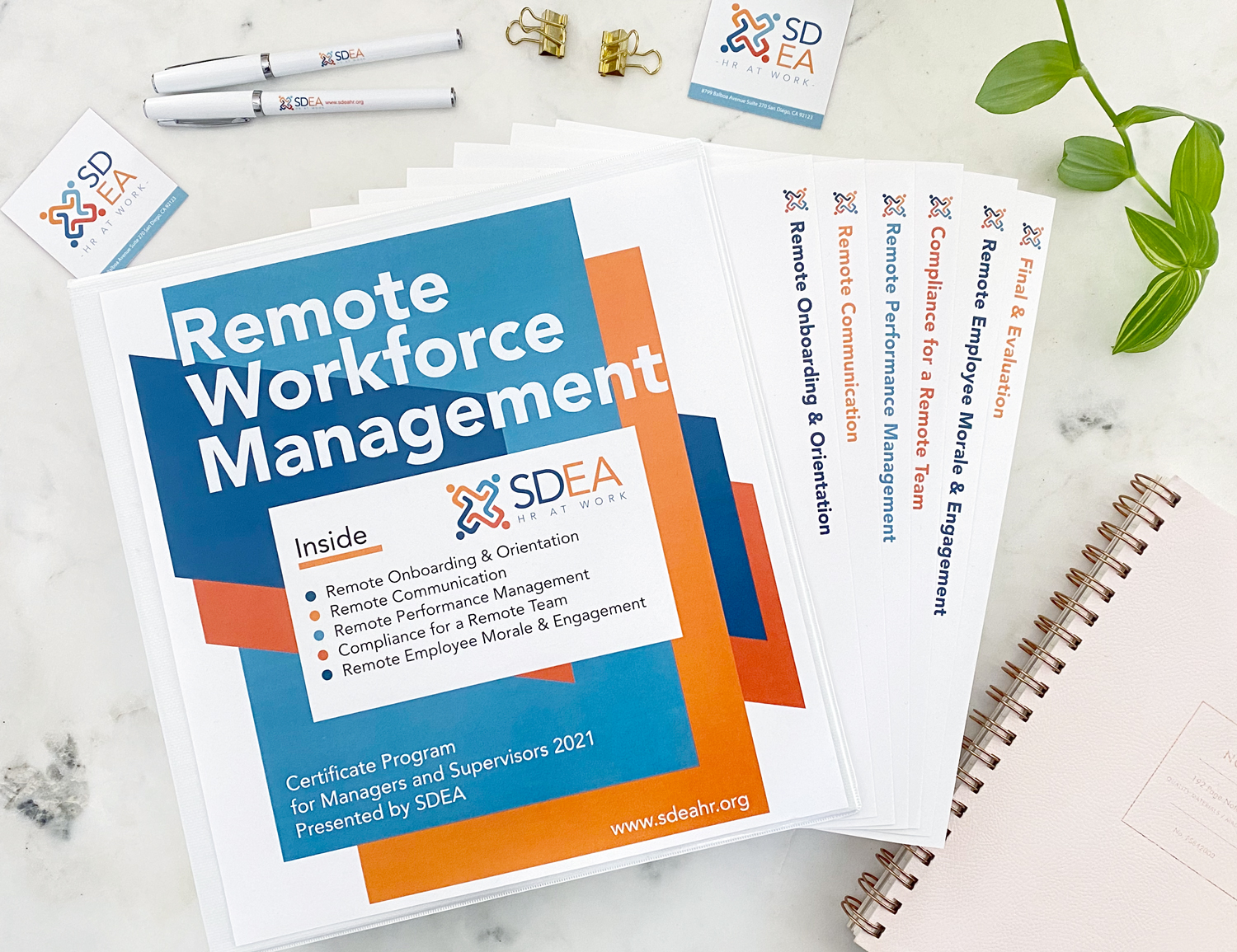

If you have additional questions on your remote workers, call SDEA at 858-505-0024. We offer a five-week certificate program, Managing A Remote Workforce, that starts August 5; call us for more information.