1.10.24

By Molly Wood, SPHR, MAOL Senior HR Consultant

Welcome to 2024! It’s a new year, a fresh start, and time to recycle your old new hire forms along with any once-living Christmas trees.

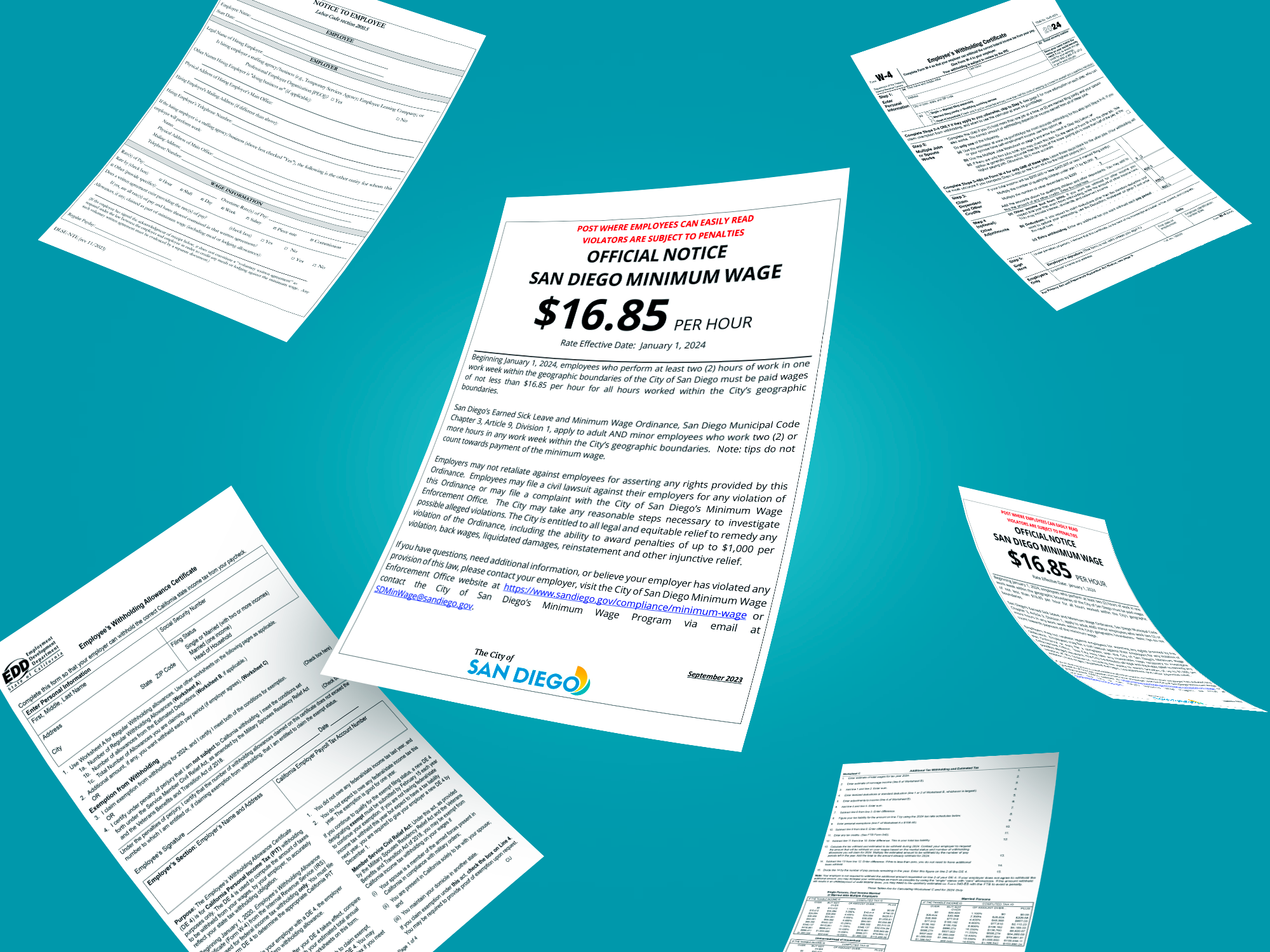

Many forms do not need to be replaced, but here is a list of those that do:

Federal Tax Withholding W4 – you are not required to get a new W4 for existing employees, but your new hires should receive the 2024 form. Click here to download

California Tax Withholding de-4 – Prior to 2020 employers could use the federal form as a default for state exemptions, but the 2020 W-4 changed deductions from number of exemptions to dollar amounts. The California form still has number of exemptions, so the two do not comply with each other. Click here to download

California Wage Notice (for non-exempt employees) – The California Wage Notice updated in November 2023 added a section for Emergency or Disaster Disclosure. This will be “not applicable” for most employers, but if there is a state for federal emergency or disaster declared (applicable to the county or counties where the employee will work) within 30 days before the employee’s first day of work, the new hire must be informed in this section. Click here to download

City of San Diego Minimum Wage Notice – Minimum wage goes up, and the notice needs to be updated. Click here to download

If you need more information on required and recommended information to provide to new hires, give SDEA a call. We are HeRe with you. 858-505-0024